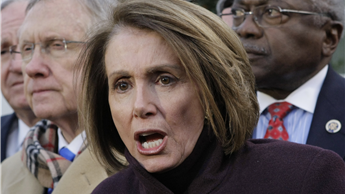

ATR today released a coalition letter signed by 70 groups and activists in opposition to the Pelosi drug pricing proposal to create a 95 percent tax on pharmaceutical manufacturers.

As noted in the letter, this bill calls for a retroactive tax on sales that is imposed in addition to existing against income taxes:

Under Speaker Pelosi’s plan, pharmaceutical manufacturers would face a retroactive tax of up to 95 percent on the total sales of a drug (not net profits). This means that a manufacturer selling a medicine for $100 will owe $95 in tax for every product sold with no allowance for the costs incurred.

The tax is used to enforce price controls on medicines that will crush innovation and distort the existing supply chain as the signers note:

“The alternative to paying this tax is for the companies to submit to strict government price controls on the medicines they produce. While the Pelosi bill claims this is “negotiation,” the plan is more akin to theft.”

This proposal will create significant harm to American innovation to the detriment of jobs, wages, and patients, as the letter notes:

”[The Pelosi] proposal would crush the pharmaceutical industry, deter innovation, and dramatically reduce the ability of patients to access life-saving medicines.

The full letter is found here and is below:

Dear Members of Congress:

We write in opposition to the prescription drug pricing bill offered by House Speaker Nancy Pelosi that would impose an excise tax of up to a 95 percent on hundreds of prescription medicines.

In addition to this new tax, the bill imposes new government price controls that would decimate innovation and distort supply, leading to the same lack of access to the newest and best drugs for patients in other countries that impose these price controls.

Under Speaker Pelosi’s plan, pharmaceutical manufacturers would face a retroactive tax of up to 95 percent on the total sales of a drug (not net profits). This means that a manufacturer selling a medicine for $100 will owe $95 in tax for every product sold with no allowance for the costs incurred. No deductions would be allowed, and it would be imposed on manufacturers in addition to federal and state income taxes they must pay.

The alternative to paying this tax is for the companies to submit to strict government price controls on the medicines they produce. While the Pelosi bill claims this is “negotiation,” the plan is more akin to theft.

If this tax hike plan were signed into law, it would cripple the ability of manufacturers to operate and develop new medicines.

It is clear that the Pelosi plan does not represent a good faith attempt to lower drug prices. Rather, it is a proposal that would crush the pharmaceutical industry, deter innovation, and dramatically reduce the ability of patients to access life-saving medicines.

We urge you to oppose the Pelosi plan that would impose price controls and a 95 percent medicine tax on the companies that develop and produce these medicines.

Sincerely,

Grover Norquist

President, Americans For Tax Reform

James L. Martin

Founder/Chairman, 60 Plus Association

Saulius “Saul” Anuzis

President, 60 Plus Association

Marty Connors

Chair, Alabama Center Right Coalition

Bob Carlstrom

President, AMAC Action

Dick Patten

President, American Business Defense Council

Phil Kerpen

President, American Commitment

Daniel Schneider

Executive Director, American Conservative Union

Steve Pociask

President/CEO, The American Consumer Institute Center for Citizen Research

Lisa B. Nelson

CEO, American Legislative Exchange Council

Michael Bowman

Vice President of Policy, ALEC Action

Dee Stewart

President, Americans for a Balanced Budget

Tom Giovanetti

President, Americans for a Strong Economy

Norm Singleton

President, Campaign for Liberty

Ryan Ellis

President, Center for a Free Economy

Andrew F. Quinlan

President, Center for Freedom & Prosperity

Jeffrey Mazzella

President, Center for Individual Freedom

Ginevra Joyce-Myers

Executive Director, Center for Innovation and Free Enterprise

Peter J. Pitts

President, Center for Medicine in the Public Interest

Olivia Grady

Senior Fellow, Center for Worker Freedom

Chuck Muth

President, Citizen Outreach

David McIntosh

President, Club for Growth

Curt Levey

President, The Committee for Justice

Iain Murray

Vice President, Competitive Enterprise Institute

James Edwards

Executive Director, Conservatives for Property Rights

Matthew Kandrach

President, Consumer Action for a Strong Economy

Fred Cyrus Roeder

Managing Director, Consumer Choice Center

Tom Schatz

President, Council for Citizens Against Government Waste

Katie McAuliffe

Executive Director, Digital Liberty

Richard Watson

Co-Chair, Florida Center Right Coalition

Adam Brandon

President, Freedomworks

George Landrith

President, Frontiers of Freedom

Grace-Marie Turner

President, Galen Institute

Naomi Lopez

Director of Healthcare Policy, Goldwater Institute

The Honorable Frank Lasee

President, The Heartland Institute

Jessica Anderson

Vice President, Heritage Action for America

Rodolfo E. Milani

Trustee, Hispanic American Center for Economic Research

Founder, Miami Freedom Forum

Mario H. Lopez

President, Hispanic Leadership Fund

Carrie Lukas

President, Independent Women’s Forum

Heather R. Higgins

CEO, Independent Women’s Voice

Merrill Matthews

Resident Scholar, Institute for Policy Innovation

Chris Ingstad

President, Iowans for Tax Relief

Sal Nuzzo

Vice President of Policy, The James Madison Institute

The Honorable Paul R LePage

Governor of Maine 2011-2019

Seton Motley

President, Less Government

Doug McCullough

Director, Lone Star Policy Institute

Mary Adams

Chair, Maine Center Right Coalition

Matthew Gagnon

CEO, The Maine Heritage Policy Center

Victoria Bucklin

President, Maine State Chapter – Parents Involved in Education

Charles Sauer

President, Market Institute

Jameson Taylor, Ph.D.

Vice President for Policy, Mississippi Center for Public Policy

The Honorable Tim Jones

Leader, Missouri Center-Right Coalition

Brent Mead

CEO, Montana Policy Institute

Pete Sepp

President, National Taxpayers Union

The Honorable Bill O’Brien

The Honorable Stephen Stepanek

Co-chairs, New Hampshire Center Right Coalition

The Honorable Beth A. O’Connor

Maine House of Representatives

The Honorable Niraj J. Antani

Ohio State Representative

Douglas Kellogg

Executive Director, Ohioans for Tax Reform

Honorable Jeff Kropf

Executive Director, Oregon Capitol Watch Foundation

Daniel Erspamer

CEO, Pelican Institute for Public Policy

Lorenzo Montanari

Executive Director, Property Rights Alliance

Paul Gessing

President, Rio Grande Foundation

James L. Setterlund

Executive Director, Shareholder Advocacy Forum

Karen Kerrigan

President and CEO, Small Business Entrepreneurship Council

David Miller & Brian Shrive

Chairs, Southwest Ohio Center-right Coalition

Tim Andrews

Executive Director, Taxpayers Protection Alliance

Judson Phillips

President, Tea Party Nation

David Balat

Director, Right on Healthcare – Texas Public Policy Foundation

Sara Croom

President, Trade Alliance to Promote Prosperity

Kevin Fuller

Executive Director, Wyoming Liberty Group