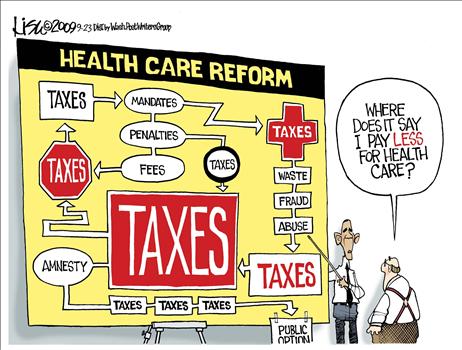

Here comes the ObamaCare tax bill.

The cost of President Obama’s massive health-care law will hit Americans in 2014 as new taxes pile up on their insurance premiums and on their income-tax bills.

Most insurers aren’t advertising the ObamaCare taxes that are added on to premiums, opting instead to discretely pass them on to customers while quietly lobbying lawmakers for a break.

But one insurance company, Blue Cross Blue Shield of Alabama, laid bare the taxes on its bills with a separate line item for “Affordable Care Act Fees and Taxes.”

The new taxes on one customer’s bill added up to $23.14 a month, or $277.68 annually, according to Kaiser Health News. It boosted the monthly premium from $322.26 to $345.40 for that individual.

The new taxes and fees include a 2 percent levy on every health plan, which is expected to net about $8 billion for the government in 2014 and increase to $14.3 billion in 2018.

There’s also a $2 fee per policy that goes into a new medical-research trust fund called the Patient Centered Outcomes Research Institute.

Insurers pay a 3.5 percent user fee to sell medical plans on the HealthCare.gov Web site.

ObamaCare supporters argue that federal subsidies for many low-income Americans will not only cover the taxes, but pay a big chunk of the premiums.

But ObamaCare taxes don’t stop with health-plan premiums.

Americans also will pay hidden taxes, such as the 2.3 percent medical-device tax that will inflate the cost of items such as pacemakers, stents and prosthetic limbs.

Those with high out-of-pocket medical expenses also will get smaller income-tax deductions.

Americans are currently allowed to deduct expenses that exceed 7.5 percent of their annual income. The threshold jumps to 10 percent under ObamaCare, costing taxpayers about $15 billion over 10 years.

Then there’s the new Medicare tax.

Under ObamaCare, individual tax filers earning more than $200,000 and families earning more than $250,000 will pay an added 0.9 percent Medicare surtax on top of the existing 1.45 percent Medicare payroll tax. They’ll also pay an extra 3.8 percent Medicare tax on unearned income, such as investment dividends, rental income and capital gains.

Meanwhile, the Obama administration touted a surge of more than 2 million visitors Monday at HealthCare.gov, plus about 250,000 calls to ObamaCare call centers.

“Volumes remain high but not equal to [Monday] and we have not had to deploy our queuing system on the site,” said Julie Bataille, a spokeswoman for the Centers for Medicare and Medicaid Services, referring to a virtual waiting room that is activated when the site is overloaded.

“We are taking thousands of calls at our call centers, which remain open until midnight, and we are seeing thousands of visitors complete enrollment online,” she said.

It wasn’t smooth sailing for everyone on the troubled site.

Software techie Jeff Karaaro tweeted in frustration: “Got three different codes trying to submit plan choices. No [one] can tell me what they mean. I nor call center can complete my application due to error.”

. . . . . . . . . . . . . . . . .

S.A. Miller and Geoff Earle write for the New York Post.