This past week, President Joe Biden unveiled his new $2 trillion infrastructure plan, scheduled for implementation over the next eight years. He delivered a pep talk about it before a union audience in Pittsburgh: “It’s a once-in-a-generation investment in America. It’s big, yes. It’s bold, yes, and we can get it done.” One central goal of his program is to tackle climate change by reaching a level of zero net carbon emissions by 2035. Many of Biden’s supporters gave two cheers for this expansion of government power, including the New York Times columnist Farhad Manjoo, who lamented that the program is too small to work, but too big to pass. Huge portions of this so-called infrastructure bill actually have nothing whatsoever to do with infrastructure.

In one classic formulation by the late economist Jacob Viner, infrastructure covers “public works regarded as essential and as impossible or highly improbable of establishment by private enterprise.” Classical liberal theorists like Viner believe it is critical to identify a limited scope of business activity appropriate for government. And even here, while government intervention may be necessary to initiate the establishment of an electric grid or a road system, oftentimes the work is completed by a regulated private firm, overcoming government inefficiency in the management of particular projects.

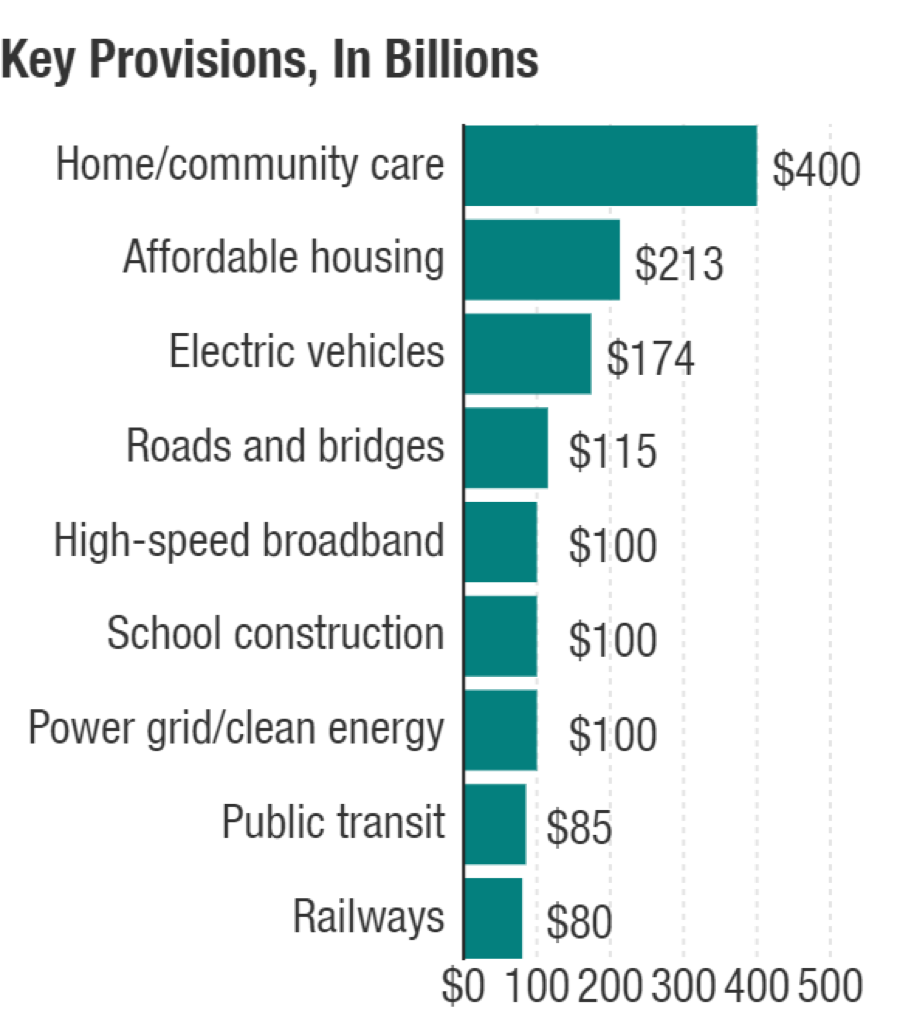

Biden’s use of the term “infrastructure” is merely a rhetorical flourish, the sole purpose of which is to create an illusion that his proposed menu of expenditures should appeal just as much to defenders of small government as it does to progressive Democrats. A quick look at the proposed expenditures shows that they include large transfer payments to preferred groups that have nothing to do with either infrastructure or climate change. Consider this chart prepared by NPR, which breaks down the major categories of expenditure:

“Home/community care” and “affordable housing” constitute over 30 percent of the budget at $613 billion. Much of this money is for child and elder care. Both are traditional forms of transfer payments, which are already available in abundance. Why more? Why now? After all, these cash transfers are not taxable compensation for work done. They increase the motivation to stay out of the workforce, in fact, and thereby reduce the size of the tax base as overall expenditures are mushrooming. Moreover, large doses of home/community care are difficult to target exclusively to the needy. A correct analysis seeks to determine whether such payments are directed toward the truly needy and whether they induce people to leave the workforce to become tax recipients rather than taxpayers.

A similar analysis applies to affordable-housing expenditures, both for renters and owners. In the Biden plan, those expenditures operate as a combined program of disguised subsidies and disguised price controls. An affordable-housing mandate typically requires a developer to build some fraction of total units held for sale or lease at below-market rates to individuals who fall within certain broad income categories. In some programs, the losses to the developer may be offset in part by government subsidies.

These programs are not only costly but also a massive disincentive to new construction, especially when the fraction of affordable units is set too high, at which point the developers cannot recoup their losses on the affordable units by their profits on their market-rate units. A far more sensible regime that reduces both rent controls and subsidies over time allows housing resources to be allocated cheaply and sensibly by market forces. Housing markets are like all others insofar as people are willing to spend other people’s money for their own benefit, which leads to overconsumption. Similarly, price controls reduce the incentive to produce housing that people want, thereby creating systematic shortages, and the long queues and political intrigues that accompany them.

The rest of the initiative’s priorities include investments in electric vehicles at $174 billion, roads and bridges at $115 billion, the power grid at $100 billion, public transportation at $85 billion, and railways at $80 billion. There is absolutely no reason to believe that these expenditures will be made in a responsible fashion, given the political forces that will descend on Washington if the proposed funds become available. Nor is there anything inherently desirable about electric vehicles, for example, that merits their subsidization. To be sure, there is a constant risk of pollution from vehicles powered by fossil fuels, but the correct response is to tax the externality in order to reduce its incidence, not to guess which alternative technology merits a subsidy. Indeed, it is especially wrongheaded to subsidize both electric cars and public transportation when they should be allowed to compete with each other. More generally, any massive subsidy for energy investment is a bad idea for the same reason that it’s a bad idea for housing: it leads to overconsumption, such that total social costs exceed total social benefits.

Shifting to wind or solar energy—both centerpieces of the Biden strategy—is also a bad idea. Those energy sources are too precarious to make more than a dent in the overall energy market. As the US Energy Information Administration reports, fossil fuels account for about 80 percent of total energy production in the United States, as well as raw materials for making “asphalt and road oil, and feedstocks for making the chemicals, plastics, and synthetic materials that are in nearly everything we use.” Keeping crude oil and natural gas in the ground is not a winning strategy. Indeed, relying on wind and solar carries risks, as these forms of energy can respond poorly in extreme situations, a reality that became clear with the breakdown of the Texas power grid recently during an extreme cold snap.

The correct path to environmental soundness lies in the more efficient production and consumption of fossil fuels. This is why one of the best ways to deal with the externalities of fossil fuel consumption, such as air pollution and spills, would be to allow the development of the Keystone XL pipeline. Given how central fossil fuels are to the energy market, any small improvement in their production and distribution will result in enormous benefits. The effort to wean an entire economy off fossil fuels over the next two decades will provide short-term dislocations without any durable long-term relief.

The dubious nature of the Biden plan is made still more evident by looking at its rickety financing. As always, the two favorite targets for new taxation are increases in the corporate income tax and the income tax rates for wealthy individuals. The claim is that these targeted taxes will spare the rest of America from financial pain. Senator Elizabeth Warren made that case for her ultra-millionaire tax, saying her wealth tax would have no impact on 99.9 percent of the population. But that is one strong reason to reject her program or others like it: it encourages majorities to confiscate the wealth of the most productive. Those majorities, of course, would be far less eager if their own taxes were to rise at the same time.

Biden has rightly rejected that approach, but the price of his new, once-in-a-generation expenditure is an increase in the overall corporate tax rate from 21 to 28 percent. Yet this proposal has dangerous consequences too. The United States constantly competes with other nations for corporate investment. Biden’s policy will reduce the level of foreign investment in the United States while simultaneously increasing the level of American investment abroad. This in turn will reverse the beneficial effects of the Trump corporate tax cuts, which notably translated into higher wages. Additional taxes on the wealthy will barely make a dent in the anticipated financial shortfall.

Worse still, it is simply false advertising to say that even if these deferred revenues could be generated, they would cover the full costs of the Biden program. The public expenditures will take place over an eight-year period. As NPR reports, the government plans to keep the corporate tax in place for fifteen years to balance the books. That move will require the treasury to borrow money to cover the anticipated revenue shortfall. And there is no reason to think that the government will meet any of its revenue targets, let alone be able to find the revenues to cover the items on the Biden agenda.

At this point, Republican skepticism about the plan may perhaps peel away some Democratic support. To avert that result, Biden would be well-advised to unbundle the strange bedfellows in his omnibus bill, so that each component can be evaluated on its own merits. The likely result is a smaller program with better outcomes, both for Biden and everyone else.