National Democrats are no doubt pleased with themselves over the way they put another one over on the American people. The poorly named Inflation Reduction Act, now law, puts in place the framework they need to create their oft-wished-for progressive utopia.- Sponsored –

Send a HeroBox Care Package Today!

It will do many things. Bringing inflation down, unfortunately for us all, is not one of them. Under President Joe Biden’s leadership, the economy has disintegrated to the point prices are rising faster now than at any time since the 1970s.

The first thing to do, in a case like that, is to stop spending. The new Biden-backed law proposes more than $500 billion in new spending over ten years, offset by what supporters of the new law argue will be $700 billion in new revenues obtained through higher taxes and more rigorous random audits, which does exactly what most serious economists recommend against in such times as these.

We are in a recession, make no mistake about it. Revised data released Thursday by the U.S. Commerce Department show the economy shrank by 0.6 percent in the second quarter of 2022 which, while not quite the 0.9 percent originally reported is still a sign that things are slipping.

The overall inflation number may be down a bit too, but that’s because the price of gasoline is coming down — though not for the reasons the Biden administration would have you believe. Energy Secretary Jennifer Granholm credits production increases for the price drop but absurdly includes in her calculations the nearly one million barrels per day of oil being released from the national strategic petroleum reserves by the president.

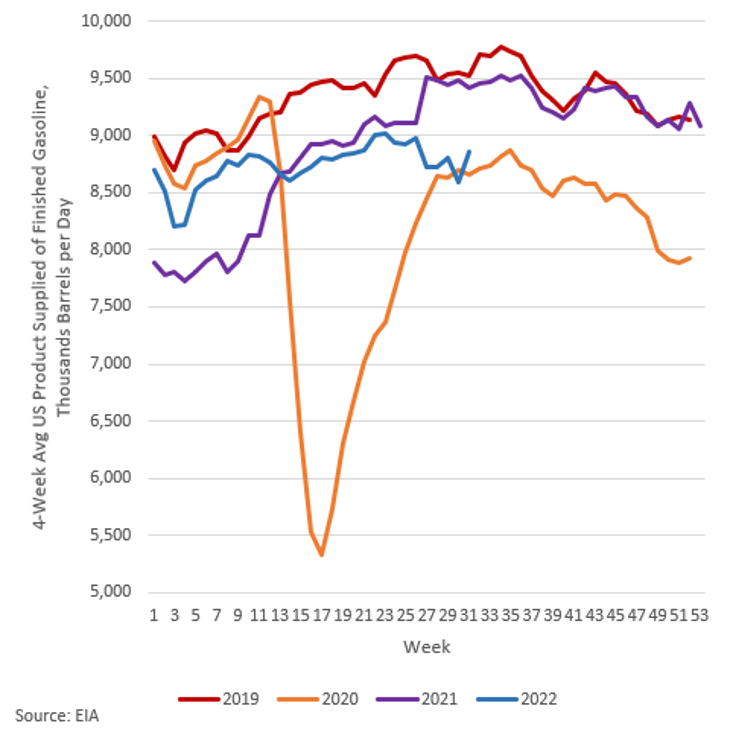

For those who don’t follow the economics of energy, that’s not an increase in production: It’s double counting. Those oil sticks have already been produced. The reason the price is coming down is that demand is coming down because the global economy is cooling off. This chart prepared by the Committee to Unleash Prosperity’s E.J. Antoni shows what’s going on:

The prices of other essential goods like foodstuffs continue to rise at frightening rates, meaning inflation will be with us for some time to come despite the legislation just shepherded through Congress by Democrats Chuck Schumer of New York and West Virginia’s Joe Manchin. All the new spending and mandates they jammed into the bill, especially what’s there to push the transition to green energy, are going to distort prices in the energy market and make matters worse.

The White House may try to dismiss that as a GOP talking point lacking a factual basis. Let them try, considering it’s been confirmed by independent, non-partisan entities including the Congressional Budget Office and Joint Tax Committee, and by a Penn/Wharton study.

Taking advantage of the public’s concerns about inflation — a Rasmussen Reports national survey found it to be the No. 1 issue on the minds of the American people — Schumer and Manchin put together a bill that repackaged much of what had been included in Biden’s twice-rejected Build Back Better bill, giving the party’s progressive wing its biggest victory in years. Party leaders, including the president, plan to spend much of September traveling the country trumpeting its supposed benefits to woo disaffected liberals back into the party before voting begins. They’ll succeed, and the numbers coming out of Tuesday’s primary elections in New York and Florida, and elsewhere suggest they already are because too many people don’t understand what the bill does and many who do won’t tell the truth about it for fear of being dismissed or attacked.

Offered as support for this theory is the fact many Democrats — and the bill passed with only Democratic votes — have already pivoted away from talking about it as a measure to bring inflation under control. Instead, they’re singing its praises as a measure that does more to combat what they call the threat of climate change than any measure passed in decades and highlighting its ill-conceived plan to cap the price of some prescription drugs.

Both measures are likely to do more harm than good because they will produce consequences that were either overlooked or deliberately ignored as the bill was being drafted. One of their biggest boasts, for example, is the notion the green energy measures in the bill will bring the rate of U.S. carbon emission production down by 40 percent by the year 2030. If that were true, it would be a big deal.

What they omit from their press releases and speeches, however, is that those same emissions were already projected to decline by 30 percent by 2030, meaning the U.S. taxpayers are spending nearly $400 billion to bring the global mean temperature down by less than a full degree — but that’s only if the Chinese stop building plants that use coal to produce electricity, which they clearly are not going to do.

The price tag for this imperceptible, perhaps unachievable temperature change — again, thank you, China — is matched by the costs imposed on working families by new taxes on the energy sector. The GOP members of the House Ways and Means Committee estimate working families will be, from an economic standpoint, disproportionally harmed by provisions including a $25 billion crude oil tax and methane taxes that will drive up the price of gasoline and the cost of operating traditional home heating and cooling systems.

The taxes included in the bill will also take a big bite out of the paychecks of people at the lower end of the economy. The Joint Tax Committee estimates more than 92 percent of households with incomes under $200,000 will either see their taxes rise or get no benefit at all. Median-income families earning between $50,000 and $75,000 will be 33 percent more likely to get a tax hike than a tax cut. Families earning $75,000 to $100,000 will be four times more likely to get a tax hike and families earning more than that up to $200,000 will be more than 10 times more likely to see their taxes go up without any adjustment in marginal rates.

That, in case there was any doubt, makes a lie out of Joe Biden’s oft-repeated promises that no one making less than $400,000 will see the amount they pay in taxes go up by as much as one thin dime. Meanwhile, the percentage of $1 million-plus households that will get a tax cut — 19.4 percent — is twice as high as any other income group, followed by those households where the annual income is between $500,000 and $1 million.

The impact on the price of prescription drugs is being equally distorted. Capping the price of current drugs will impede the discovery of new ones. Those that are created and make it to market will do so at higher prices than might have been the case had House Speaker Nancy Pelosi’s price control scheme not been adopted. As a result, Americans will be spending more at the pharmacy and on health insurance premiums, something that is again unnecessary and inflationary.

The Inflation Reduction Act, about which you will hear much over the next few weeks though perhaps not under that name, will accelerate the increase in inflation, not bring it down. Consumer prices are headed skywards, even if the price of gasoline continues to come down. In sum, it makes living in America less affordable in the future than it was when Joe Biden took office. That’s not what people expected would happen. They have the right to know why it will.