by Alfredo Ortiz • Real Clear Politics

Pending tax cut legislation will eliminate the federal income tax burden on the average American family earning $59,000 a year. It will halve the tax bill for the average family earning $75,000. And it will allow the overwhelming majority of small businesses to protect nearly one-quarter of their income from taxes.

That’s the bottom line of the tax bill that needs to be said up front.

Given the critical media coverage of the bill, these benefits have largely gone overlooked. Rather than reporting on its provisions to double the standard deduction, double the child tax credit, and eliminate the 15 percent tax bracket in favor of a vastly expanded 12 percent rate, media coverage has claimed the bill is a gift to the rich. Rather than reporting on the new 23 percent tax deduction for small businesses earning less than $500,000 a year, media

coverage has claimed the bill is a budget buster.

That’s a shame because these benefits would bring long overdue relief to hardworking taxpayers who have borne the brunt of the slow growth Obama economy from which the country is finally emerging. Median wages were essentially flat between 2009 and 2016, while sputtered along at roughly 2 percent – both of which the tax bill would also meaningfully address.

The thousands of additional dollars in the pockets of ordinary Americans as a result of this tax bill will finally give them more financial breathing room. It will allow them to cover an unexpected $400 expense, something the Federal Reserve finds nearly half of Americans currently cannot.

For small businesses, the new tax deduction will allow them to more easily compete with their big business and international competitors, which face much lower tax rates and therefore enjoy a competitive advantage. The bill’s provisions to allow for immediate capital expensing and interest expense write-offs will make expansion cheaper and easier.

And these are just the direct impacts of the tax bill. Ordinary employees will not only see an immediate raise in their paycheck due to less federal tax withholding, but many will also receive raises or new job opportunities because small businesses will have more funds at their disposal. According to a recent national poll of owners conducted by the , most respondents said they’d use their tax cut savings to raise wages, create jobs, or expand operations.

Less money taken out of paychecks and more money put in that’s the recipe to cure the wage stagnation that is a priority for policymakers from across the political spectrum.

Just as would increase paychecks, they’d also jumpstart the country’s local economies, which have

largely been passed over by the economic recovery. More money on Main Street and less sent off to

Washington, D.C., would stimulate local investment, consumption, and job creation.

Contrary to critics’ claims, the tax bill will therefore help ordinary Americans – not the rich the most. But what of critics’ other contention that the tax bill will increase the deficit? Here, too, they are mistaken.

The cost of tax bill is $1.5 trillion. But according to the Congressional Budget Office, each 0.1 percent increase in economic growth adds over $250 billion in tax revenue. That means that if tax cuts merely increase growth from roughly 2 percent to 2.5 percent, they will pay for themselves. And a new U.S. Treasury analysis expects them to do just that, increasing economic growth by 0.7 percent per year, more than making up for their cost.

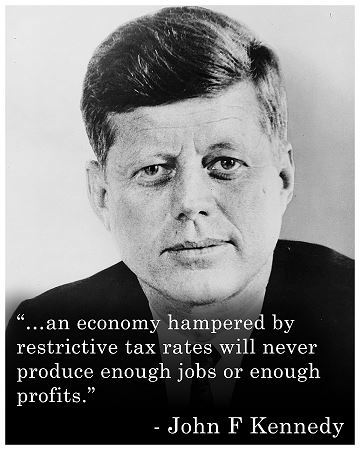

History backs up Treasury’s conclusion. The Reagan, Kennedy, and Coolidge administrations, among others, cut taxes and increased revenues. President Reagan’s across-the-board cuts in the 1980s contributed several years of 4 percent economic growth that resulted in a roughly 25 percent increase in real income tax revenues over the course of his term.

Good for ordinary Americans. Good for small businesses. Good for local economies. This tax bill is the Christmas gift they’ve been waiting for. Legislators must pass it now