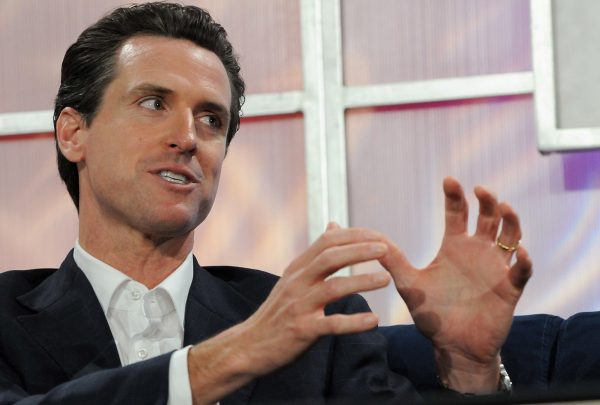

California’s high tax, generous welfare state policies, and the dominance of progressive politics have combined to create an environment causing voters to leave the state at can only be described as an alarming rate. For the first time since statehood in 1850, California is losing rather than gaining a congressional seat as a result of the decennial census and the ensuing reapportionment of the 435 districts in the U.S. House of Representatives among the 50 states. It’s an alarming reality for the state Ronald Reagan and his sunny optimistic brand of growth-oriented conservatism once called home.The economy is in the doldrums, and not just because of the strict lockdowns instituted by Democratic Gov. Gavin Newsom in the face of the coronavirus pandemic. Even with that, the state budget surplus for 2021 is projected to exceed $75 billion which, instead of being returned to the taxpayers through tax relief, is likely being socked away for the day when it’s needed to bail out the generous social welfare programs and government employee pensions the Democrats trade in exchange for votes to keep them in power.“California used to be a place where everyone wanted to live, but now California has become a place where people want to leave,” Brandon Ristoff, a policy analyst with the California Policy Center told Center Square driven out by “bad policies on the economy, education and more.” State-to-state migration data recently released by the U.S. Department of Internal Revenue (IRS) shows a net loss of nearly 70,000 households plus – which works out to about 165,000 taxpayers and their dependents – between 2017 and 2018.If that’s not bad enough, lawmakers in Sacramento now must worry about the impact of their departure on future budgets since they took nearly $9 billion in adjusted gross income with them when they left, The Epoch Times reported.Like New York City, California working hard to drive its tax base out of the state. Longtime residents are retiring elsewhere. Younger voters are leaving to pursue job opportunities in other states. Major businesses are relocating. Too many people, especially those who make up the middle class, are adversely affected by the high cost of living there – especially the housing market which is soaring to unaffordability for so many people – are now finding the Golden State an impossible place to live.Where are they going? Texas and Nevada – which have no state personal income tax, and Arizona – where the governor and members of the GOP-controlled state legislature are exploring ways to get rid of it.

-Texas experienced a net inflow of 72,306 taxpayers and their dependents, and a gross income boost of some $3.4 billion.

-Nevada welcomed 49,745 California taxpayers and their dependents, along with a gross income of $2.3 billion.

-Arizona saw an estimated 53,476 Californians relocated to Arizona, bringing with them around $2.2 billion in gross income.

Some policymakers still refuse to believe tax rates matter, that they have no incentive effect. Economist Arthur Laffer – developer of the famous “curve” that bears his name – proved they do. California has a state-local effective tax rate of 11.5 percent, the 8th highest in the nation in 2019 according to a recent Tax Foundation study. The effective state-local tax rate in Texas is 8 percent, in Nevada, it’s 9.7 percent, and in Arizona it’s 8.7 percent, making them (in order) 47th, 45th, and 29thout of 50.A 2018 Cato Institute report also showed the relationship between state-local tax effective rates on out-of-state migration. Tax-related motivations could be inferred from the Census Bureau data, The Epoch Times reported, citing the think tanks’ observation that some of the questions asked of people choosing to relocate show the incentive effect at work.“The Census Bureau does not ask movers about taxes. But some of the 19 choices may reflect the influence of taxes. For example, people moving for housing reasons may consider the level of property taxes since those taxes are a standard item listed on housing sale notices. Similarly, people moving for new jobs may consider the effect of income taxes if they are, for example, moving between a high-tax state such as California and a state with no income tax such as Nevada,” CATO said.If California doesn’t change its ways soon, it may find it has taxed its way into default. Illinois and New Jersey are in similar straights. There’s a lesson here for Democrats and Republicans in Washington who, despite the apparent end of the pandemic, still spend like there’s no tomorrow. If they continue to do that, there won’t be.